Research Reports

Forced Arbitration and Big Banks: When Consumers Pay to Be Ripped Off

Sept. 2022Highlights

- Just 237 Americans out of 13,179 won monetary awards against banks and other financial services companies in forced arbitration at the American Arbitration Association (AAA)—the largest arbitration provider in the country—during the five years from 2017 to 2021, making for a win rate of just 1.8%. That makes the likelihood of winning a forced arbitration case against a bank nearly half the overall win rate against all corporations, which was already a pitiful 4.8%.

- In more than 100 cases, Americans brought a forced arbitration case against a bank, only to be ordered to pay the bank. Those Americans ended up paying an average of approximately $24,000 each to the banks they had filed cases against.

- Americans bringing claims against Discover were the most likely to end up paying the bank. One in five Americans who brought cases against Discover ended up being ordered to pay the bank. In fact, an American bringing a case against Discover was 28 times more likely to end up paying the bank than receiving any money themselves.

- Americans brought $2.8 billion worth of claims against banks and financial services corporations but won only 0.5% of that (approximately $13 million) during the five years from 2017 to 2021.

When Seeking Justice Against a Bank is Worse than Gambling

Making a claim against a bank in forced arbitration presents a very special risk—having to pay the bank money for bringing the case—according to a new analysis of data taken from the country’s largest forced arbitration provider, the American Arbitration Association (AAA).1

Over the last five years (2017-2021), 104 Americans attempting to bring forced arbitration cases against banks found themselves having to pay money to the bank, despite the fact they, the consumer, initiated the case. Those 104 Americans ended up paying an average of approximately $24,000 each.

In two cases, consumers brought cases against a corporation, one against student loan corporation Navient and one against Zion Bank, only to be ordered to pay the corporation nearly $500,000.

One bank, in particular, benefited from consumer-initiated cases—Discover. One in five consumers who brought cases against Discover ended up paying the bank. In fact, a consumer bringing a case against Discover was 28 times more likely to end up paying the bank than receiving any money themselves.

Discover was not the first bank to profit so well from forced arbitration. Between 2009 and 2016, Wells Fargo opened 3.5 million bogus bank and credit card accounts in its customers’ names. Many of these customers found themselves incurring fees on accounts they never knew they had, saw checks bounce and overdraft fees pile up, and had their credit scores tailspin. When the bank’s scam was discovered, those customers found themselves unable to take the corporation to court because of forced arbitration agreements in their original, legitimate accounts.2

According to an analysis by the Economic Policy Institute, only 250 customers pursued forced arbitration against Wells Fargo in the wake of the scandal. Shockingly, those Wells Fargo customers were ordered to pay the bank nearly $11,000 in compensation.3

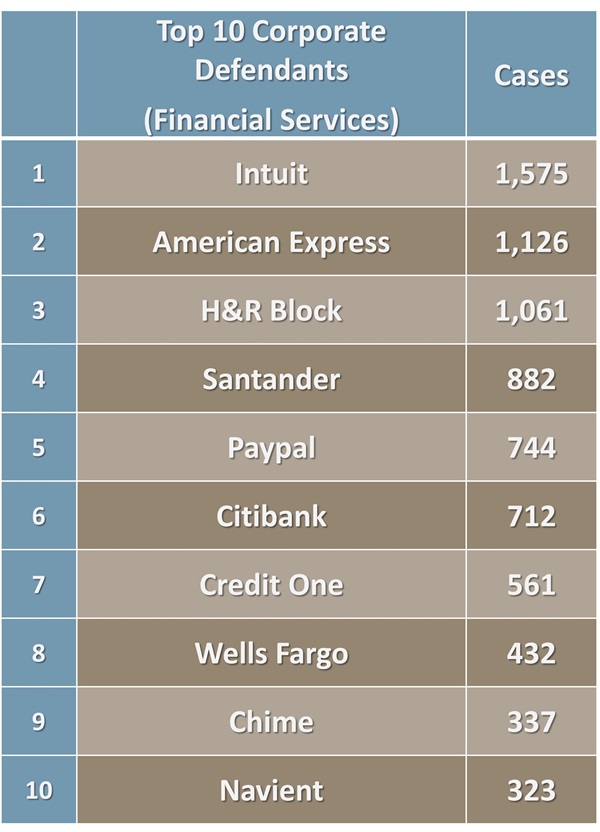

AAA—Financial Services Companies Using Forced Arbitration, 2017-2021.

Forced Arbitration Claims Against Banks Feature Some of Forced Arbitration’s Lowest Win Rates

Putting aside the risk of having to pay the bank money, Americans were exceptionally unlikely to win their cases. Just 237 consumers and employees won monetary awards in forced arbitration against banks and other financial institutions at AAA during the five years from 2017 to 2021, making for a win rate of just 1.8%. That makes the likelihood of winning a forced arbitration claim against a bank less than half the win rate against corporations from all sectors, which was already a pitiful 4.8%.

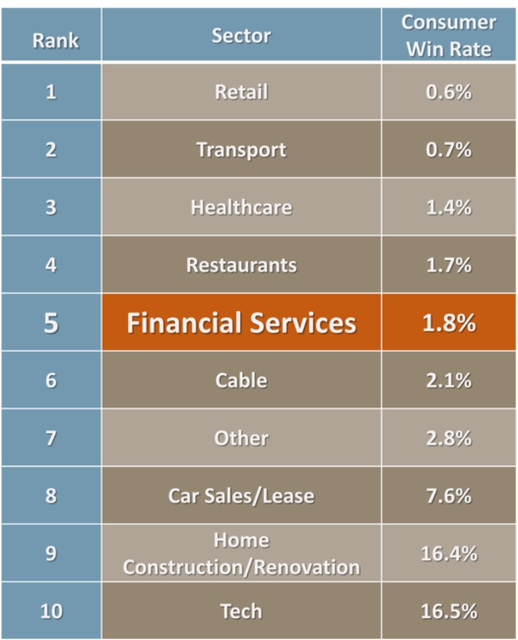

The 1.8% win rate against financial services corporations is one of the worst in forced arbitration. Of the top sectors, only retail, restaurant, healthcare, and transport—categories that are dominated by employee claims—had worse win rates. In sectors made up of predominantly consumer claims, no win rate was worse than financial services, not even complaints against cable companies.4

In the employee space, just three corporations—Citibank, Corelogic, and JPMorgan Chase—accounted for 38% of all employee forced arbitrations over the five-year period. Only two employees from any of the three corporations won compensation in their claim, making for a 0.5% win rate.

Consumers brought $2.8 billion worth of claims against banks and financial services corporations over the last five years but were awarded only 0.5% of that (approximately $14 million). By comparison, the 10 banks and financial firms using forced arbitration most frequently took in $1.7 trillion in revenues over the same five years.

Meanwhile, AAA itself reaped over $13 million in fees for bank-related cases over the five years.

AAA—Financial Services Companies Win Rate in Forced Arbitration, 2017-2021.

Banks and the “Repeat Player” Phenomenon

Individuals’ win rates dropped even further when they faced corporations that were “repeat players.” Repeat players is a term describing corporations that frequently utilize forced arbitration. Forced arbitration’s repeat player problem renders it inherently unfair. Corporate repeat players become highly adept at navigating forced arbitration proceedings and can potentially select arbitrators with favorable track records. Most corporate forced arbitration clauses even commit to paying the associated fees because forced arbitration is such a good deal for them.

The repeat player effect certainly has an impact in the financial sector. The consumer/employee win rate against financial services corporations with 10 or more prior forced arbitrations was just 1.1%—less than half the overall 2.8% win rate.

Again, Discover led many of its fellow banks. AAA’s records show that Discover appeared before AAA arbitrators at least 757 times, though the true number is most certainly higher due to variations in Discover’s title in the AAA database. Not only was Discover a repeat player, but the bank managed to get claims in front of repeat arbitrators—arbitrators Discover had used at least once before—in 38% of the claims against it.

Even Discover did not claim the title of #1 repeat player. AAA data shows Intuit—maker of TurboTax—had historically appeared before AAA arbitrators a whopping 39,000 times, nearly twice the number of any other corporation (second was Amazon, with 24,000 prior arbitrations).

Conclusion

Banks and financial services companies have long used forced arbitration to escape accountability, particularly because forced arbitration allows them to eliminate group actions in which thousands or millions of Americans have been abused in the same way—such as class actions. Today, approximately 20% of all forced arbitration claims are against banks, credit card companies, or other financial services corporations.

Unfortunately, banks and financial services companies have gone beyond using forced arbitration as a Get-Out-of-Jail-Free card.

- The country’s second-largest forced arbitration provider, JAMS, does not list banks or financial services as a category and does not differentiate which parties won an award, making their self-reported data unusable in this context.

- Wells Fargo Must Pay $185 Million After Opening Customer Accounts Without Asking. That’s Not Enough, Slate, September 8, 2016, https://slate.com/business/2016/09/wells-fargo-to-pay-185-million-for-account-opening-scandal-that-s-not-enough.html.

- The average consumer in arbitration with Wells Fargo is ordered to pay the bank nearly $11,000, Economic Policy Institute (EPI), October 3, 2017, https://www.epi.org/press/the-average-consumer-in-arbitration-with-wells-fargo-is-ordered-to-pay-the-bank-nearly-11000/.

- AAA also lists data on the prevailing parties. Despite initiating just a fraction of the number of claims that consumers did, corporations were listed as prevailing in 360 cases, more than twice the number of prevailing consumers (160). However, as previous research has demonstrated [see, for instance, The Truth About Forced Arbitration, American Association for Justice, September 2019] this prevailing category appears highly unreliable—for instance, consumers listed as prevailing frequently were ordered to pay corporations. To be conservative, we chose to define wins as cases in which consumer received monetary awards.

Contact AAJ Communications by phone at 202.684.9588 or email media.replies@justice.org. Contact Us